|

PIP lawsuits explode to recordBy Charles Elmore - Palm Beach Post Staff Writer

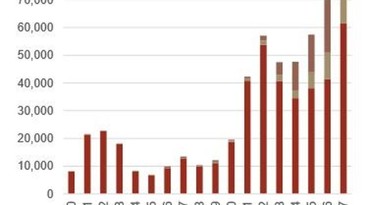

More than 60,000 cases were filed in Florida courthouses in 2017 involving the state’s no-fault car insurance system, research shows. Posted: 2:06 p.m. Friday, February 23, 2018 A no-fault car insurance system that was supposed to reduce lawsuits in Florida has instead produced a record mountain of more than 60,000 in 2017, a new report shows. That represents a stunning rise of close to 50 percent in one year, according to data from The Florida Justice Reform Institute, a group that says it fights against wasteful litigation. So are insurers rushing to tell legislators to repeal Florida’s Personal Injury Protection system before the session ends in early March? Guess again. An insurance industry group never mentions PIP in its statement on the lawsuit report and has urged lawmakers to put off repeal another year. Who benefits from keeping the current system? Florida’s top 25 car insurers have raised PIP rates up to 54 percent since the start of 2017, and on average hiked them 35 percent faster than overall premiums, The Palm Beach Post reported. Florida drivers pay among the nation’s top six car insurance bills in one of the few states that retain a no-fault system. The state forces drivers to buy $10,000 of PIP to cover the driver’s own injuries in an accident regardless of who is at fault, no matter how much health insurance the consumer already has. One of the justifications for PIP when it was created the 1970s was to reduce lawsuits after minor car accidents. Almost half a century later, PIP’s relatively small benefit has hardly changed and in no way kept up with medical inflation, yet it is driving consumer rate increases and, in a final irony, leading the lawsuit parade. Who’s suing? The lawsuits measured in the report are typically not filed by ordinary drivers but chiropractors, clinics, imaging centers and other medical providers suing insurers to get paid for PIP claims, researchers say. PIP represents by far the largest source for a type of lawsuit that FJRI officials say is responsible for more than half of the state’s overall insurance litigation and is driving up consumer costs. It’s associated with an arrangement known as “assignment of benefits” or AOB. It happens when third parties like a repair contractor or medical clinic tell consumers we’ll handle the claim for you if you sign this form assigning us the insurance benefit. It’s not uncommon in health care and other fields. Insurers say the trouble is, Florida’s laws provide too many incentives for some of the third parties take the insurers to court. Yet you’d never know that PIP was involved in any way from an insurance industry group’s statement on the AOB lawsuit report. The focus is exclusively on property insurance claims representing about one-sixth as many suits compared to PIP, and auto windshield claims representing about a third as many. Insurers say these categories are growing, and PIP repeal must wait for reforms affecting lawyer fees that have stalled in the legislature for half a dozen years and seem likely to deadlock again. “We are seeing an increase in the number of property and auto glass claims because one-way attorney fees are incentivizing AOB abuse,’’ said Logan McFaddin, the Florida-based regional manager for the Property Casualty Insurers Association of America. “Legislative reform is desperately needed to curtail the number of fake or inflated claims and lawsuits. Now is the time for legislators to protect Floridians from these bad actors and help reduce insurance costs.” OK, but how about repealing PIP and lopping off the source of the majority of AOB suits in one stroke? Then pursue additional lawsuit reforms? At least two important insurance lobby groups in Tallahassee, PCI and the Personal Insurance Federation of Florida, say no thanks. William Large, the president of the Florida Justice Reform Institute, acknowledged “it is no secret PIP has major problems.” He said his group’s position “has been to not hastily move to another system that also lacks necessary legal reforms, causing the replacement coverage to be similarly exploited.” Not every voice in the insurance world is urging legislators to go slow on PIP repeal. Despite “good intentions and policymakers’ repeated efforts to fix it, Florida’s PIP system has produced prolific fraud, abuse, and lawsuits,” said Ron Jackson, southeast region vice president for the American Insurance Association. He urges legislators to back the House bill and maybe go one better: Throw in a “no pay no play” rule that would mean drivers who do not buy required insurance could could not recover non-economic damages such as “pain and suffering,” which studies show could save another 6 percent on drivers’ bills, he said. He said it’s time to “move Florida to a system far less susceptible to fraud,” one that most states use with lower rates, that would “save Floridians money.” But with gridlock, drivers get stuck with the same system — and the bill. A state-commissioned actuarial report said drivers could save up to $81 per car if Florida repealed PIP and required bodily-injury liability coverage. A bill that passed the House 88-15 would do that. Florida is one of only two states that do not require BI insurance to make drivers responsible for injuries to others. A Senate PIP repeal bill remains stuck in committee as the session nears its end. Asked by a Post correspondent about the issue, Senate President Joe Negron, R-Stuart, offered a recap of committee stops with no comment on whether leadership believes it merits further attention or a vote on the floor. “That bill has moved through one committee in the process with a favorable vote and is now in health and human services appropriations (committee), so it would be up to that committee to decide whether they want to take up the bill in the final time we’re here for session,” Negron said Feb. 15 “The short answer would be it’s undetermined.” Instead of championing a chance for driver savings, insurers put out their own report that said rates would go up 5.3 percent under the House bill. The report prepared by Milliman Inc. for PCI acknowledged it used unverified, unaudited data from a subset of member companies that could be “biased” and chose to ignore any savings from eliminating PIP fraud. A group representing trial attorneys blasted it as not credible and inconsistent with the state report and with consumer savings in other states that dropped no-fault systems, including Colorado and Georgia. So what’s the story? Insurers raise rates up to 54 percent in a year for PIP. Then lobbyists claim late in the session that rates would also go up under the House repeal plan. They encourage legislators not to believe a state-commissioned actuarial report that said drivers could save an average of near 6 percent on their overall bills after PIP repeal. Now a report shows PIP is responsible for most of the lawsuits insurers are complaining about. It’s the elephant in the room, the biggest part of the mountain. But apparently it’s not fit for mention everywhere. Correspondent Kenya Woodard contributed to this report. ___________________________________________________ Lawsuit Spike Florida’s Personal Injury Protection system was pitched in the 1970s as a way to avoid lawsuits in minor accidents, requiring that drivers buy $10,000 of coverage for their own injuries. But something odd happened. PIP lawsuits, mostly medical providers suing insurers to get paid, rocketed nearly 50 percent in one year to a record high in 2017 among what are known as “assignment of benefit” or AOB lawsuits, a new study shows. That’s when a third party like a repair contractor or clinic tells consumers sign a form and we’ll handle the claim. Citing this study, an insurance industry group warned of AOB dangers in property insurance and auto windshield claims, but a statement never mentioned PIP and lobbyists urged legislators not to repeal the no-fault system this session. Year / PIP AOB lawsuits 2017 61,583 2016 41,368 Source: Florida Justice Reform Institute

https://www.mypalmbeachpost.com/news/pip-lawsuits-explode-record/Jhbp8XBsvvBsuS0yXXsMwK/

|