A New Approach to Fixing Florida’s Mortgage Crisis

William Large: A new approach to fixing Florida’s mortgage crisis

Posted Jun 20, 2011 at 9:42 AM

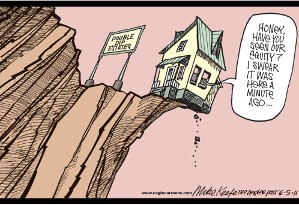

Perhaps no other state in the country has been harder hit by the country’s mortgage crisis than Florida.

Our state accounted for nearly a quarter of all homes in foreclosure during the first quarter of 2011 and 23 percent of loans here are in some stage of delinquency, according to a quarterly report released last month by the Mortgage Bankers Association.

In fact, Florida has more homes in foreclosure than 22 other states have loans, according to the group.

While the market continues to erode, we must find a way to preserve the American dream of homeownership, without forcing aggressive government intervention. That’s why I support Florida Attorney General Pam Bondi’s decision to take a step away from proposals that seek to use the courts to fix the country’s mortgage crisis with national loan remodification programs.

General Bondi recognizes the detrimental impacts such broad national housing policy could have on homeowners in our state if government-induced litigation is the standard by which we modify mortgage contracts in Florida.

Such a move would only worsen the state’s current mortgage crisis by enabling a moral hazard where people will stop paying mortgages because they think that they will now get them modified. Government intervention, including the bailouts, is always bad.

The proposed multi-state lawsuit against the mortgage servicers is just the latest example of an increasing trend of “regulation through litigation” where multi-state lawsuits are used as a financial and political lever to drive overly broad public policy.

Such an approach seeks to use the courts to impose sweeping mortgage-industry changes with the same economic detriment and consequences as administrative regulations.

General Bondi was right to join Attorneys General from three other states in voicing concern about the impacts and application of an overly broad national mortgage remodification program.

In a letter to their colleagues in other states, Bondi and General Greg Abbott of Texas, General Alan Wilson of South Carolina, and General Ken Cuccinelli of Virginia, address various concerns with proposals and warn that lenders “who may prefer to avoid responsibility for their improper conduct have been aided by [the] proposal for a broad, new regulatory regime.”

They caution their colleagues, that if adopted, some of the proposals would force Attorneys General to be deeply involved in the review and monitoring of mortgage providers everyday business practices and would go so far as mandating automatic review of modification denials whether or not requested by the homeowner, and even dictating how payments should be applied.

These and other terms could have the unintended effect of unnecessarily prolonging the foreclosure process and further delaying the recovery of the housing market, proving yet again that government-imposed solutions to problems in the financial markets are more hindrance than help.

Florida’s housing crisis is real and continues to threaten the state’s economy. Courts, lawyers, and our General Bondi all have roles to play in resolving it, but if new regulations are needed, they should come from the Legislature rather than being mandated by the courts.

William Large is president of the Florida Justice Reform Institute. The Florida Justice Reform Institute’s mission is to fight wasteful civil litigation through legislation, promote fair and equitable legal practices, and provide information about the state of civil justice in Florida.