How Florida’s ‘unscrupulous’ auto glass shops fuel an insurance crisis

A coterie of glass repair shops and lawyers has exploited legal loopholes in Florida to rake in millions of dollars in insurance payouts. Legislators are trying to end it.

Eli Nan

Eli Nan

November 12, 2023 at 9:21 a.m. EST

(iStock/Getty Images)

(iStock/Getty Images)

They roam Florida parking lots and carwashes in search of cars with damaged windshields, often bearing gifts; gift cards, steak dinners and discounted hot tubs are the common ones.

Insurance companies call them “harvesters,” and their sales pitch to car owners is simple: Auto glass shops can offer free windshield replacements because it’s covered by comprehensive insurance. All they need is a signature.

But after the signature is collected and the repair is made, the glass shops send exorbitant bills to insurers, who often deny or pay out a lesser amount for the claim. Lawyers then sue the insurance company for payment and the cost of legal fees, often settling hundreds of lawsuits at a time for a hefty sum.

It’s all part of a network of out-of-state companies and lawyers that have carved out an entire industry based on these glass replacements — so costly to insurance companies that it has caused rates to skyrocket across the state, consumer advocates say.

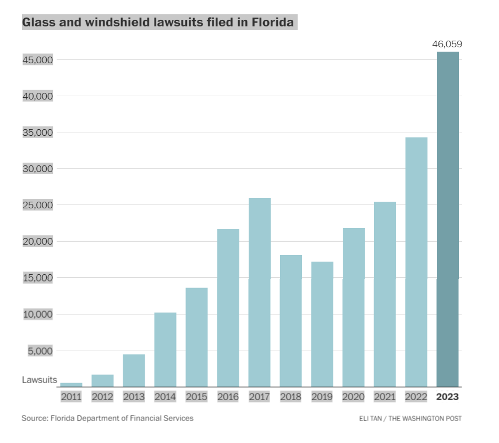

The tactic is common only in Florida, where more than 46,000 auto glass lawsuits have been filed so far in 2023, according to data from the state’s Department of Financial Services.

Laws meant to protect consumers have fueled the trend, which has exploded over the past several years — only 591 such Florida lawsuits were filed in 2011. Advocate groups point to the burgeoning industry of “unscrupulous” auto glass shops and lawyers as a leading factor behind the state’s high insurance costs.

The lawsuits have been inflaming an already bleak auto insurance market in Florida — a state whose average auto insurance premium of $2,560 is the highest in the country. The issue of auto glass litigation has become so dire that legislators have passed two laws in the past year to try to slow it down.

While car insurance rates are rising faster than inflation nationally, Florida’s increases have been the most drastic — the average premium today is 88 percent more expensive than a decade ago, according to figures from industry data firm Insure. Insurers have blamed the costly premiums on hurricanes and a high percentage of uninsured drivers, but the companies seldom mention that they also are passing on the cost of auto glass litigation.

When Florida resident Francinete Borgstrom was approached last December in an Orlando parking lot by an auto glass salesman, the offer “didn’t sound any alarms,” she said. The salesman told her that Auto Glass America could replace her broken windshield without a deductible, so she signed the waiver with no questions asked.

Borgstrom said she didn’t realize that when she signed away her assignment of benefits — that is, authorized the glass repair company to assume her rights under her insurance policy to seek payment for the work — she also gave the shop the right to sue the insurer in her name if necessary. Auto Glass America did just that when the insurance company, AssuranceAmerica, refused to pay the bill of $1,461. That price is more than four times the average cost for that type of repair, based on figures cited in a lawsuit filed against the same repair shop by another insurance company, Allstate.

These glass shops primarily target older people, immigrants and nonnative English speakers, consumer advocates said and court records suggest. Borgstrom, who immigrated to the United States from Brazil, did not know a lawsuit had been filed in her name until she was contacted for this article.

A representative from Auto Glass America declined to comment on its business model but said the company no longer offers gifts in exchange for servicing. The other glass repair shops mentioned in this article did not respond to requests for comment.

“Not only will it most likely lead to a higher rate at their next renewal date, but it has the potential to generate a nonrenewal at the end of their current policy period,” said Mark Friedlander, director of communications for the Insurance Information Institute. “The average $30 repair could be a six-figure impact on an auto insurance company.”

Gift cards and steak dinners

The auto glass shops contract harvesters to find customers, sometimes even going door-to-door, lawsuits by insurance companies allege. Along with a free glass replacement, the harvesters at times offer gifts to entice their targets, some as valuable as $200.

Once a glass company persuades a driver to agree to the replacement and sign away their assignment of benefits, the shop adds “unreasonable fees and tack-ons” to the insurance claim, said Michael Carlson, president of the Personal Insurance Federation of Florida, an industry trade group.

When the insurance companies pay out a lesser amount for the replacement or reject the claim entirely, the glass shops sue for the remainder of the bounty. Then come the lawyers.

Until the recent changes passed by state lawmakers, Florida had what are called “one-way attorney’s fees” — a requirement that the insurer has to cover the plaintiff’s reasonable legal fees if it loses or settles a claim. These litigation fees are “where the real gravy is,” said Capital City Consulting partner Ashley Kalifeh, who worked with Florida regulators to close loopholes in the state’s insurance laws.

These fees are concentrated in a small group: Just 20 lawyers file 96 percent of the glass lawsuits in Florida, according to data commissioned by the Florida Justice Reform Institute.

Attorneys who file the lawsuits argue they’re helping individuals battle a large, entrenched system.

“The idea was to balance out the scales of power between a multibillion-dollar insurance carrier and Mom and Joe,” said William England, an attorney for Chad Barr Law who specializes in auto glass litigation. “If it comes down to being abused, there’s always a few bad apples in any society.”

The initial lawsuit filings are typically just a few pages long and based on a template that can be filled in with the name of the insured driver and the date of repair, a streamlined process that helps auto glass lawyers quickly file thousands of cases with relative ease.

Lawyers will offer to settle bunches of lawsuits for a single sum, Carlson said. That’s cheaper for insurers than litigating each case individually, even if some are winnable, because the insurance companies can pass the costs of settlement to policyholders, according to Friedlander.

But insurance companies would rather not have to deal with the mass lawsuits at all. In a lawsuit filed by Allstate against Auto Glass America in 2019, the insurance giant called the practice a “greedy scheme to extract as much money as possible.” The combined cost of Auto Glass America’s claims and litigation against Allstate in 2017 and 2018 exceeded $600,000, according to the lawsuit. “The effect of AGA’s unlawful and inequitable conduct is substantial,” it added.

Jannet Mehmed, 76, had the glass replaced on her 2017 Toyota Camry by Orange Blossom Auto Glass after finding the company through an online search in August 2022. Mehmed’s State Farm agent later called her with bad news — she had been charged $1,812, well over market rate.

“Senior citizens are very trusting,” Mehmed said. “You give them the impression that you’re going to help them, and they’ll open their checkbooks.”

Some lawsuits by insurance companies allege that harvesters forged signatures of drivers who turned down their offers. Others allege that glass shops never made the repairs after collecting the signatures, but still filed claims.

Fixing the cracks

For years, the practice of filing auto glass lawsuits has existed within the legal boundaries thanks to one-way attorney’s fees and loose insurance regulations. When the lawsuits spiked in 2019, a coalition of insurance groups called for changes in the state’s laws through an initiative called Fix the Cracks.

The initiative, led by the Personal Insurance Federation of Florida and funded through trade associations by Allstate, Farmers Insurance, Progressive and State Farm, helped pass two laws intended to shut down Florida’s freewheeling auto glass industry and put an end to “windshield bullies,” according to its website.

The first measure, passed in December 2022, barred one-way attorney’s fees for insurance-related claims. The second, passed in May, prohibited the transfer of assignment of benefits for auto glass repairs, making it harder for glass-replacement companies to fix windshields without first contacting the insurance companies. The May law also makes it illegal for glass companies to offer free perks in exchange for services.

But auto glass lawsuits continue to roll in, court records show. The assignment-of-benefits law applies only to insurance policies renewed or reissued after May 26, 2023, Kalifeh said, leaving a six- to 12-month period for lawyers to file as many lawsuits as possible before all existing policies have been renewed — 46,059 lawsuits were filed from January to August, according to data commissioned by the Florida Justice Reform Institute.

Some of the plaintiffs’ lawyers argue that insurance companies still stand to profit from the changes in Florida’s laws. Imran Malik, a lawyer who filed over 7,000 glass lawsuits in 2022, said insurers have used the cost of litigation as a “convenient scapegoat” for raising rates but have yet to lower them since the new laws were passed.

“Even with all the changes that have occurred in the law, not one insurance company has reduced their rates at all,” Malik said.

The insurance companies, Malik added, have long had “cushy relationships” with larger glass shops such as Safelite, which smaller glass shops take business away from. Safelite did not directly answer emailed questions about its relationship with insurance companies.

“There’s not a lot of clean hands in this industry,” said Florida attorney Zachary Hicks, who has worked on auto glass litigation cases since 2019. “The problem is that plaintiff’s lawyers will abuse the system if you let them. Insurance companies will abuse the system if you let them. … Insurance companies got exactly what they wanted — they eliminated it all — and rates are still up.”

Hicks added that he himself was recently dropped by Geico for not carrying minimum liability car insurance, even though he pays for a Geico umbrella policy.

The total costs of claims made by glass shops and their litigation costs are unknown, but Kalifeh estimates them to be “easily in the tens of millions of dollars a year.”

England and Hicks believe, however, that the new laws will effectively end auto glass litigation as an industry once the grace period for filing lawsuits is over. When it does, it is unclear by how much insurers will reduce premiums. State Farm, Allstate and Progressive declined to comment on how the lawsuits affect individual rates.

https://www.washingtonpost.com/business/2023/11/12/auto-glass-florida-insurance/